Revenue vs Profitability

Introduction

It is well known and documented that for the past 22 years the arena of Public SaaS companies has been generally unprofitable, as such the overabundance of capital from the Venture Capital community has subsidized their losses. This capital has held the objective of “acquiring market share at all costs”.

However, as we enter a prolonged period of inflationary pressures, rising interest rates and significant political disruption capital will become more expensive, coupled with the increasing need for “Investors” to achieve profitability NOW.

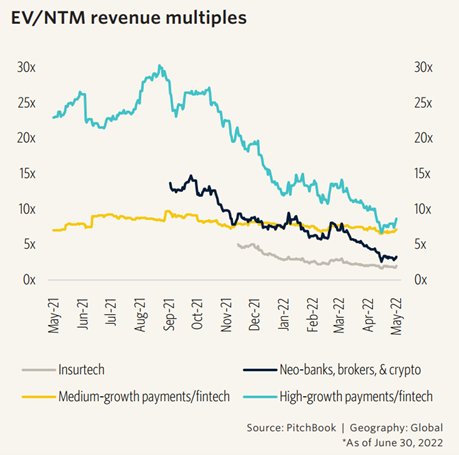

Currently, we are experiencing valuations of “Unprofitable Technology” companies that are 10x less than their profitable counterparts.

Furthermore, a rise in interest rates is not favorable for companies that rely on cash flows to justify their valuations as the cost of financing will increase and therefore decreasing the cash available to the company. With lower valuations and less liquidity in the market to support exits; timing liquidity events and exits will be crucial over the near term.

For CEO Entrepreneurs and Founders to attract ‘Useful Capital” and have multiple options or “Founder Friendly Capital” available they must balance Revenue growth with Profitable growth or (EBITDA and cashflow)

Is revenue more important than profit?

Venture funding has grown more than 120% in the US in the last five years. With this “overabundance” availability of capital, Founders and Investors alike have grown increasingly comfortable with low-profit margin business models, however, that “build it and they will come” model, inserts “intolerable” risk in the current inflationary and difficult environment for the small business.

Revenue and Profit are equally important because SaaS or technology-enabled business services companies are valued based on their ability to grow revenue and create cashflow EBITDA or “profit”.

EBITDA or Profit allows the company to become attractive for the following reasons:

1. It allows the Company to Fund Growth & Investment Initiatives

o The best and cheapest way for a CEO Entrepreneurs/Founders to finance the growth of their businesses is through cashflow/EBITDA from operations.

This will allow the company to invest in talent, technology, and other organic growth initiatives without the need for interest payments.

2. Make the Company attractive to Institutional Lenders & Equity Investors

o Profit and Cashflow create the ability to pay interest for Lenders & Investors, this allows the company to negotiate better terms and have multiple financing options: Debt or Equity.

3. Valuations are based on Cashflow EBITDA Multiples

o We expect over the near term that valuations will shift from more revenue oriented to EBITDA multiple oriented combined with ROI of invested capital. Valuations are driven by the EBITDA created by the company, by carefully managing the EBITDA/Cashflow or profit of the business we can ensure that we are not “suppressing” the value of the company or if needed we can time it based on the “Strategic” objectives of the company and its exit plan.

How do you calculate profit vs revenue?

To calculate profit vs revenue, it is best to understand the revenue vs profit per Unit or what is called “Unit of One Economics”. Unit of One Economics (Unit Economics) are the measures of the revenue, cost, and profitability of “one unit” of your product or service.

In other words, if you produce a chair and sell chairs, the “unit economics” will be a relationship between the revenue you receive from selling a chair and all the costs associated with producing the chair and selling the chair.

For companies offering a service, for example, Uber, the unit economics will be the relationship between the revenue from their service (e.g., one passenger ride) vs. the costs associated with offering and servicing that customer.

At a high level, the purpose of unit economics is to understand how much profit a business makes before fixed or administrative costs so that one can estimate how much a business needs to sell in order to cover its fixed or administrative costs. Unit economics are the fundamentals of business.

There are 3 main fundamental Measures or Metrics of Unit Economics:

1. Average Income by Client

a. If multiple services or lines of business exist, we can also look at the Average Income by Service/Lines of Business

2. Cost of Customer Acquisition

3. Customer Turnover/Attrition

Average Income by Client/Service

The Average Income by client is the total revenue generated by every unit/customer for a specific time period or year i.e. Year End 2021 (January through December 2021)

This can allow the company to better understand which products/services are generating the most revenue, which products/services are being adopted by its target market so the company can then focus our efforts on those products/services.

Further analysis will need to be done to determine if our highest Unit Revenue services are our most profitable.

Cost of Customer Acquisition

The cost of Customer Acquisition are the costs the company spends to acquire one customer. This will include the total all of costs associated with marketing, staff salaries, and sales over a time period. By understanding our Cost of Customer Acquisition, the company can then start identifying ways to lower its Customer Acquisition Cost by:

Shortening the Sales Cycle

Customer Turnover /Attrition

Customer Turnover, Attrition, or Churn rate, is the rate at which your customers stop purchasing your products or services measured across a specific period of time. This could tell us that your products have only temporary value. In the case of a recurring revenue or subscription business model, that competitive offerings have higher appeal, or that your customer service is sub-par.

Why are Unit Economics Important?

Businesses are complex and depend highly on systems of processes (Especially Labor-Intensive Service Business). With so many moving pieces, and complexities it can be overwhelming to determine which information, KPI’s, measurements and metrics to track. By understanding Unit Economics, it makes the business simpler to understand and where should the leadership focus their time to drive the most value and Maximize Revenue, Profit and Increase the Probability of Success of your business.

Unit Economics allows us to understand if scaling the current business model makes both sense and “$$ cents”. If a business loses money on every sale, then growing that business will only increase the amount of money that is lost.

The “scale it first, make it profitable later” mentality without spending any time thinking about whether their business can ever be profitable is yesterday’s news.

By understanding unit economics, you can determine the:

1. Allows us to focus on those “things” that create the most value

2. Make Pricing Adjustments based on Company Margins and Market Feedback.

3. Make Projections around how fast you can grow the business and what resources are needed

4. Time the Investments so as to not sacrifice profit

5. Finally, CEO Founders can answer if Scaling the Business makes sense

How do you Calculate Unit of One Economics?

1. Average Income by Client

a. To calculate Average Income by Client, take: Total Sales/Revenue for the Year i.e. 2021 / by the Total Number of Active Customer for 2021.

2. Cost of Customer Acquisition

a. To calculate Cost of Customer Acquisition, take the total spend on advertising, marketing, and sales costs over the year.

3. Customer Attrition/Churn

a. To calculate Customer Attrition, take: the total number of customers lost and the related revenue for the year.

One final note, most of the well-established financial or accounting metrics are ill-suited in today’s complex service environment for strategic decision-making or empowering operational business models and process improvements.

A highly skilled Fractional CFO who is sector knowledgeable and a domain specialist will develop and implement sector/industry-specific and company-specific measurement and metrics (Management Science) that better orients the Leadership Team to improve the business process, and increase customer value, achieve cost scalability, productivity enhancement.

If you’d like help book a consultation for a complimentary Industry Benchmarking, Opportunity, and Gap Analysis.