Top 4 Best Fractional CFO Companies: “Your Partner for Planned Success”

Introduction

Due to our current inflationary and political disruption, especially for small to medium size businesses (SMB’s) and the complexities involved, the daily tactical and strategic demands on Founders & CEO Entrepreneurs are often overwhelming and require a “holistic” skill set that generally is difficult for most leaders and management teams to illustrate.

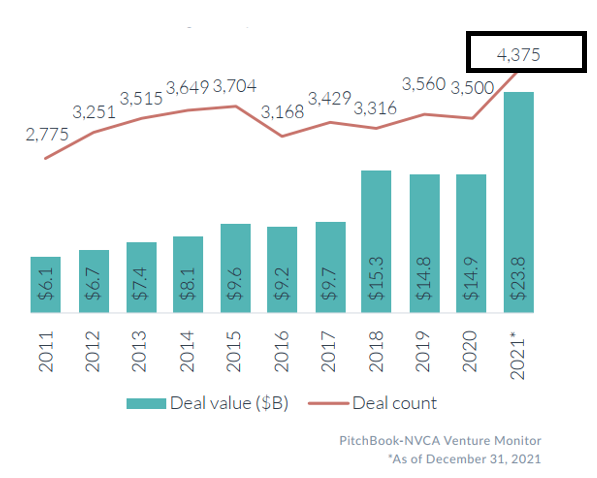

Studies show that in 2021 about 600,000 businesses closed their doors and only 4,375 businesses raised institutional capital in 2021. The ever-changing demands and skill requirements required by Founders & CEO Entrepreneurs makes “the holistic leadership” task nearly impossible.

Hiring a highly skilled and experienced CFO professional can help you and your business increase the consistent profitability of your business, grow your sales without sacrificing profits, increase the enterprise value of your company, create a business model that is process driven, combined with a financial and operational reporting structure that is attractive to institutional investors.

Below are some considerations:

What are the Companies Objectives & Do They Illustrate “Clarity”?

For best results, you will need to clarify your objectives and set well-defined expectations. The Founder/CEO Entrepreneur will need to clarify what objectives needed to be achieved and highly define what you the CEO and the Fractional CFO need to achieve “collectively”.

While every company has different requirements for success generally, they can be summarized as follows:

What growth options are available for the company (Organic Growth vs M&A or other Corporate Development Programs?

What are the growth objectives of each growth venue?

Does the company have sufficient capital to achieve its objectives?

If not, what are the “most appropriate" sources and cost of capital?

Does the company have the skill and expertise to raise the “most appropriate” capital?

Is the business “scalable” and illustrate increases in productivity?

Does the company need to address operational issues?

Does the company have a Monthly Financial and Operational Reporting Process and Publication?

Often to properly evaluate you and the company’s needs from a Fractional CFO, you may also request an evaluation or “Opportunity and Gap Analysis” to understand how the Fractional CFO will begin the engagement and provide h a high-level set of recommendations.

What should you look for in a Fractional CFO?

The needs of an SMB and or high growth-oriented early-stage companies are different from those of a larger -size company or even a public corporation. Based on your company objectives and the stage of the lifecycle of your company, you can ask the CFO candidate if they have “been there and done that” successfully with other companies in your industry and lifecycle.

Specifically, The Fractional CFO should illustrate the following attributes:

Are they focused on a specific Industry and are they domain experts?

Therefore, they can share best practices and comparable operational and financial performance data from the other participants in your segment or niche.

Have they successfully addressed the specific issues you have identified and do their skill set aligns with your company's needs and objectives?

What are the typical results they delivered for their clients?

Ensure that they can provide you with a minimum of 2 case studies

Are they Industry or Sector Experts?

Seeking expert advice from a Fractional CFO that has your specific Industry/Sector that brings valuable insights from someone who knows exactly what you need to know but you get answers that are objective and precise. They will help you avoid making mistakes, and help achieve long-term goals. Furthermore, it will shorten the learning and growth curves of your business and maximize value.

If your company is performing, they can help “fine-tune” and/or;

If your company is underperforming, they can create a plan with the necessary changes needed and create specific scalability metrics to pragmatically monitor performance improvement;

Finally with their intimate knowledge of the industry/sector they can implement the necessary processes, and changes needed to engage and educate the leadership in creating a “perform & accountability-based culture”.

Are you looking for a Vendor or a Strategic Partner?

A vendor relationship will provide is a purely transactional service with no proactive ideas, no sense or accountability of results, and most likely a lack of a deep understanding of your business, or capital needs and structure of your as opposed to a partner who will immerse themselves into your business operations, culture, address the real needs and “remediation” programs that address the tactical and strategic needs to achieve the business objectives.,

A Vendor relationship will provide a transactional exchange and will deliver the service based upon some agreed-upon terms. Boundaries will be clearly defined and based on a limited set of communication. There is no investment from a vendor or additional value to the business. Vendors are best suited for an exchange of services for fixed periods based on an agreed scope of tasks and activities.

A Partnership on the other hand offers value-add as there is shared risk and reward and every solution is customized to the specific business. A partner also embeds the solution into the company culture and values. A partnership involves mutual investments, aligned goals, trust, and achieving near & long-term outcomes.

What makes for a successful “Strategic Partnership” Relationship with a Fractional CFO Professional?

Founder/CEO Entrepreneur and Executive team are Committed to Long Term value Maximization vs Short Term Revenue or Profit

Decisions are Made based on Pragmatic Facts, Good Business Acumen, and with Input from Professionals, and With a Long-Term Perspective.

Pragmatic relationships with all stakeholders are established, not based on “Biased Feelings”

Leadership that is Management Science-centric, that enables Leaders to be “effective” through management science “Facts” and process, not position power or control behaviors.

They are “Always Striving to Learn”: They Surround Themselves with People That Challenge Them and They can Learn From

A highly skilled Leadership Team that utilizes “Outside Expertise” and that is empowered within the organization

They are no “events” or “activities” of transactional nature occurs, if it does it is treated as a process failure, and/or a leadership failure

Top Fractional CFO Companies

Preferred CFO

Industry Focus:

Education/SaaS Entertainment, Television, Film, & Podcasting Technology, & Transportation, Electrical Equipment Manufacturing & Installation, Sports Equipment Manufacturing, Security & Asset Monitoring

Services Offered:

Financial Strategy - Short- and Long-Term Forecasting

Financial Systems Strategy & Design - Budgeting

Facilitating & Interpreting Financial Reporting

Raising Capital - Capital Structure

Cash Flow Analysis & Restructuring - Making Cost Cuts

Facilitating Mergers & Acquisitions

Typical Result:

Set high financial standards early to keep the company’s finance strategies clean, complete, and optimized

Complete financial turnaround

Successful exit with a well-aligned strategic partner

Streamline their sales order completion times, reduce inventory write-off, and fully utilize existing accounting staff

Helping to raise debt and equity capital

Leader’s background:

Preferred CFO was founded by Jerry Vance. With 30 years in the financial industry and more than 40,000 billable hours as an outsourced fractional CFO, Jerry is highly regarded as one of the most experienced outsourced CFOs in the United States. Jerry has personally provided CFO services to more than 300 companies in a wide range of industries. He has been instrumental in securing hundreds of millions of dollars of debt and equity financing and has been integral in advising his clients in sustainable long-term growth. He enjoys mentoring early-stage companies and is an active angel investor.

CFO Share

Industry Focus:

Manufacturing Distribution, Transportation, Real Estate, Consumer Packaged Goods, Cannabis, SaaS, Professional Services, Internet of Things, MedTech, Construction

Services Offered:

Financial Strategy - Short- and Long-Term Forecasting

Budgeting

Facilitating & Interpreting Financial Reporting

Raising Capital - Capital Structure

Cash Flow Analysis & Restructuring - Making Cost Cuts

Facilitating Mergers & Acquisitions

Typical Result:

Set high financial standards early to keep the company’s finance strategies clean, complete, and optimized

Streamline their sales order completion times, reduce inventory write-off, and fully utilize existing accounting staff

Helping to raise debt and equity capital

Leader’s background:

Founder of CFOshare, LJ is a serial entrepreneur and expert in pricing strategy, business development, and cost of growth analysis. LJ knows from experience what it takes to grow a small business.

Sabre Financial Group

Industry Focus:

Manufacturing Distribution, Transportation, Retail, Healthcare, Oil & Gas, Commercial Real Estate, Security, Telcom

Services Offered:

Financial Strategy - Short- and Long-Term Forecasting

Budgeting

Facilitating & Interpreting Financial Reporting

Raising Capital - Capital Structure

Cash Flow Analysis & Restructuring - Making Cost Cuts

Facilitating Mergers & Acquisitions

Typical Result:

Set high financial standards early to keep the company’s finance strategies clean, complete, and optimized

Streamline their sales order completion times, reduce inventory write-off, and fully utilize existing accounting staff

Helping to raise debt and equity capital

Leader’s background:

Rob is a board-licensed Texas CPA and the President & Managing Partner of Sabre Financial Group. Highly analytical and recognized as a strategic and forward-looking thinker, Rob is also a skilled teacher and facilitator, committed to raising the financial awareness of business professionals within an organization and mediating difficult business problems to achieve a favorable outcome for all parties. Rob has substantial experience and technical expertise in small-business finance, financial planning & analysis, budgeting, forecasting, economic modeling, cash and working capital management, risk mitigation and investment evaluations. An alumnus of Price Waterhouse and a graduate of the McIntire School of Commerce at the University of Virginia, Rob has served as a strategic advisor and financial expert in both corporate and consulting capacities during his 25+ year career.

Vantage CFO

Industry: N/A

Services:

Financial Strategy - Short- and Long-Term Forecasting

Budgeting

Facilitating & Interpreting Financial Reporting

Cash Flow Analysis & Restructuring - Making Cost Cuts

Facilitating Mergers & Acquisitions

Typical Result:

Ensure financial statements are structured correctly and maintained accurately.

Reports that deliver the "so what" and answer key questions critical to the business.

Study the road ahead with advanced proforma development and cash flow forecasting.

A strategic partner to your management team, helping to improve your finance and accounting function.

Leader’s background:

Ray DeLaughter is the founder and CFO of VantageCFO. He has a unique skill-set that comes from experience as a small business owner and experience consulting with Fortune 500 companies. Before starting our part-time CFO company, Ray worked in the Mergers & Acquisitions and Restructuring Group at Deloitte Consulting. He has extensive experience in finance, including budgeting & forecasting, performance management, organization restructuring, and investment due diligence. Ray has a BA in Finance from Texas A&M University and an MBA from the University of North Carolina.